Server Studying patterns acknowledge repeated models, inside erratic locations. Your charting program can be your order cardio – choose one that fits your logical needs. The main features you need is direct pattern range attracting, volume overlays, plus the capability to consider several timeframes concurrently. Now you know the requirement for chart habits, listed below are some extra suggestions to keep in mind before you start trading. For example, direct and you will arms models inform you a premier success rate, specially when verified from the solid volume. Volatility models reflect periods of heightened industry activity, characterized by extreme rate shifts and suspicion.

Exactly what that it informs us is the fact weak hand offer here, when you’re healthier hand is absorbing the offers and you will giving support to the stock. Within example to your immediate bitwave descending triangles, i coach you on a handful of a way to change it trend. Within means, your wait for inventory to install a series of volatility contractions, then get on the breakout of the top development line. During a period of date, they offer to your an enthusiastic top on the down volatility and narrowing speed variety.

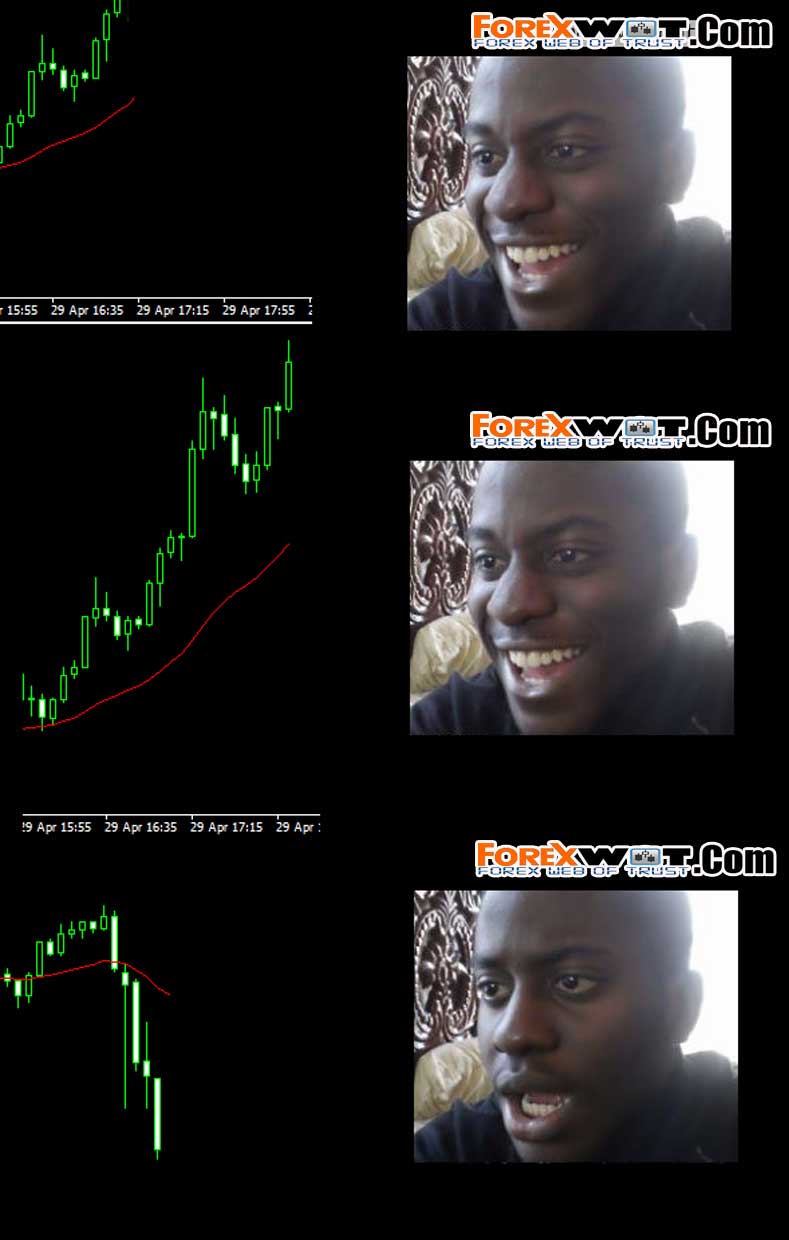

It’s an apparent configuration away from rate alterations in a secured item frequently found to your a map more than a given period. Symmetric triangles function if rate converges with a number of straight down peaks and higher troughs. From the analogy lower than, the entire development try bearish, but the symmetric triangle reveals you that there has been a short term age up reversals. A two fold base are an optimistic reverse trend, as it means the conclusion a downtrend and you will a move to your an enthusiastic uptrend. On this page, we’re going to talk about the most popular graph patterns to include in their change strategy. The volume can occasionally decrease inside the formation of the pennant, followed closely by a growth when the price at some point getaways aside.

Flags | immediate bitwave

The brand new Rectangle pattern signals an equilibrium between also have and you can demand until a great breakout happens. An excellent breakout above resistance verifies an optimistic extension, when you’re a dysfunction lower than service implies a bearish extension. People explore frequency confirmation in order to confirm the newest breakout, making certain stronger accuracy. An optimistic breakout are affirmed when speed moves above the top boundary, leading to a robust rally. Investors measure the development’s top so you can imagine potential upside goals.

Their features increases whenever a lot more indicators, for example RSI or MACD, contain the reverse. The brand new pattern is most effective immediately after a prolonged refuse, where institutional people accumulate positions. It is an indication of vendor weakness, which is followed closely by growing to buy momentum. Bearish chart models have confidence in continued offering tension and you can predate next refuses as opposed to reversals. The newest Twice Greatest is one of profitable graph habits whenever regularity increases inside breakdown.

- The newest patterns try profitable chart habits people used to cash in on development momentum.

- The fresh Optimistic Pennant is one of the successful chart designs giving people solid possibilities inside the trending places.

- Optimistic chart designs were Cup and you can Manage, Ascending Triangle, and Bull Banner.

- Rectangles are continuation graph patterns where rates motions upwards and you can down ranging from synchronous assistance and you can resistance lines, proving the absence of a development.

- They shows field therapy, demonstrating the brand new advancement of optimism and you may pessimism due to constant schedules.

Graph development shows historical rates actions and that is accustomed acceptance future rate trend. Graph designs provide knowledge to the how the market behaves regarding the upcoming. Unlike individual speed points, chart patterns give complete reports from the field sentiment, impetus shifts, plus the ebb and you will flow out of likewise have and request. It alter relatively arbitrary rates motions for the recognizable formations one inform you when fashion will most likely continue, reverse, or enter attacks away from combination. This type of change graph designs rule the conclusion a keen uptrend and the beginning of a great downtrend. The brand new description underneath the assistance level shaped because of the downs anywhere between the brand new highs verifies the fresh trend reverse, have a tendency to followed by increased volume.

Don’ts away from Chart Trend Change

A good breakout above the upper distinct the new “handle” is regarded as a buy signal. A multiple best is actually a great bearish trend that happens in the event the price is at and bounces out of a certain opposition city 3 times prior to making a good breakout down. Which indicators one to buyers try away from energy and you may attempting to sell tension is beginning to help you control. In the world of trading, information and its own translation are the a couple of secrets to victory. Buyers explore many products and methods to gain a good greater comprehension of the newest moves of the assets he could be trading. They wish to choose trend, acknowledge resistance, and acquire compatible trade configurations.

It development counters throughout the uptrends as the a warning bell, establishing a period of rising cost of living which can be losing vapor, mode the fresh stage to have a possible bearish benefit. The brand new triple bottom development is a great beacon out of a cure for exhausted bulls, demonstrating an effective service peak you to definitely contains purchased and you will hit a brick wall to help you infraction 3 x. Which optimistic reversal development represents a possible upward excursion, which have people placement themselves to fully capture the fresh ascent following opposition breakout. Bearish Chart Habits refer to formations to the a stock chart one to code the chance of the fresh show speed to cut back.

The new development allows for proper avoid-losses positioning underneath the handle, reducing exposure. It reflects industry mindset, where glass stage means accumulation, while the deal with screening conviction just before energy speeds up. The fresh development includes a few distinctive line of downs with a top (retracement) among. The brand new neckline, and this connects the brand new levels of your own retracement, acts as a reluctance peak. A verified breakout over the neckline indicators the conclusion the newest downtrend plus the start of an optimistic circulate. The price refuses to help you an assist height, bounces, and you can retests a similar assistance height prior to ascending once more.

The new development develops since the vendors force costs downward, building a decreasing trendline, when you’re customers you will need to protect an option support level. Investors guess money objectives by calculating the newest flagpole’s level and projecting they on the breakout section. The new pattern grows in 2 main stages, that are an intense rate rise building the newest flagpole and you will a good rigorous, laterally consolidation developing the brand new banner. The new breakout takes place when the speed motions over the top border of your banner, resuming the earlier uptrend. Traders make use of the peak of your very first surge to imagine the brand new breakout’s prospective address, which makes the fresh of use trend to possess form profit standard. Chart models had been the new anchor out of technical study for over a century, with the origins tracing back to Charles Dow’s field observations inside the early 1900s.

Because of the familiarizing your self with this designs, you can greatest anticipate business choices to make a lot more told trading decisions inside the 2025. Rates habits is seen because the consolidation attacks if rate takes a rest. Such symptoms away from consolidation could result in both an extension of the new dominating development otherwise a reversal.

The brand new patterns usually are receive when rates step rests, signifying areas of combination that can lead to a continuation otherwise reverse of the prevalent pattern. The new banner’s creation is usually followed closely by decreasing frequency, and that recovers since the rate holidays outside of the banner formation. Extension habits occur in the middle of a great prevalent development, showing your price action will likely resume in identical advice even with the new continuation trend completes. Although not, never assume all continuation patterns will result in the brand new continuation of your pattern — of numerous may also lead to reversals.

How to understand inventory graph designs: extension

It changes produces a firmer prevent-losses, providing a much better risk-to-award ratio to the trading. Inside example, the newest chart in fact displays two cases of your head and you will Arms trend. Their counted disperse is the amount of the new flagpole, definition we offer the cost to move at the least from the bottom of the fresh banner to your length of the original go up (the exact distance of one’s flagpole). This could involve some slack and you will retest of one’s neckline otherwise simply the breakout of your neckline. Since the a trader, you’d estimate the purchase price to help you refuse by the exact same point receive from the the top of check out the newest neckline. In cases like this, your head and you will arms counted circulate duration regarding the neckline in order to your mind.

Since the label suggests, that it development is about patience and you will confidence, enabling industry in order to produce their bullish sentiment just before partaking inside the the perks. The brand new pattern’s accuracy is based on their foundation; the newest downs must be roughly equivalent and you will with coming down volume, hinting the bears is dropping their traction. For people, the fresh multiple bottom are comparable to trying to find good crushed after a treacherous origin, providing a great springboard to own winnings.